inherited annuity taxation irs

Annuities are often complex retirement investment products. Ad Help Fund Your Retirement Goals with an Annuity from Fidelity.

Inherited Non Qualified Annuities For Spouses Non Spouses And Trusts Bsmg Brokers Service Marketing Group

Tax Consequences of Inherited Annuities.

. How taxes are paid on an. If you opt to receive a lump-sum payment of all. Surviving spouses can change the original contract.

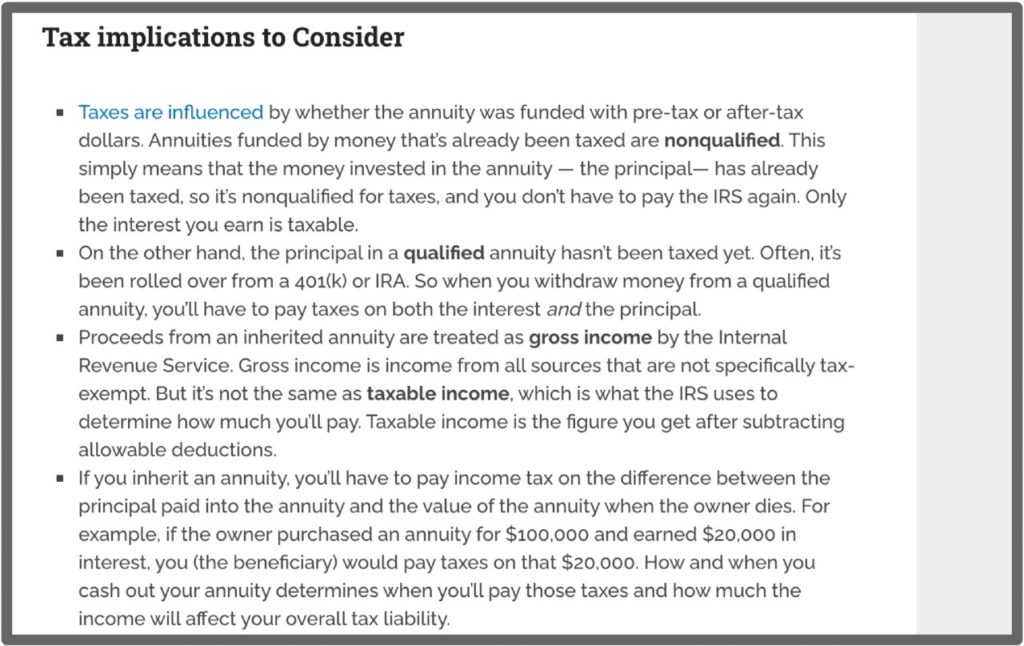

Learn some startling facts. IRS Publication 575 says that in general those inheriting annuities pay taxes the same way that the original annuity owner would. Tax obligations may possibly be deferred by rolling the lump-sum distribution over into an individual retirement account.

Get Personalized Rates from Our Database of Over 40 A Rated Annuity Providers. If the annuity is an immediate annuity. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

The internal revenue service IRS taxes annuity income to the extent of gains distributed from the contract and gains are distributed first. The basis of property inherited from a decedent is. See How We Can Help.

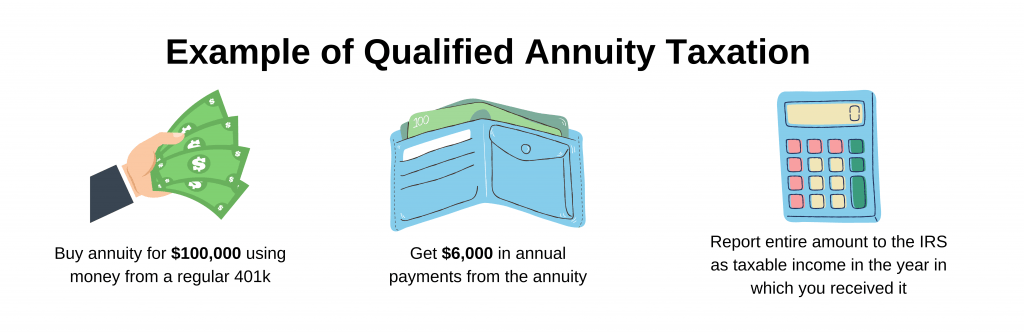

According to the IRS. People inheriting an annuity owe income tax on the difference between the principal paid into the annuity and the value of the annuity at the annuitants death. Ad Help Fund Your Retirement Goals with an Annuity from Fidelity.

In turn taxation of annuity distributions. Investments That Adjust Over Time with a Goal of Carrying You To and Through Retirement. Fixed period annuities - pay a fixed amount to an annuitant at regular intervals for a definite length of time.

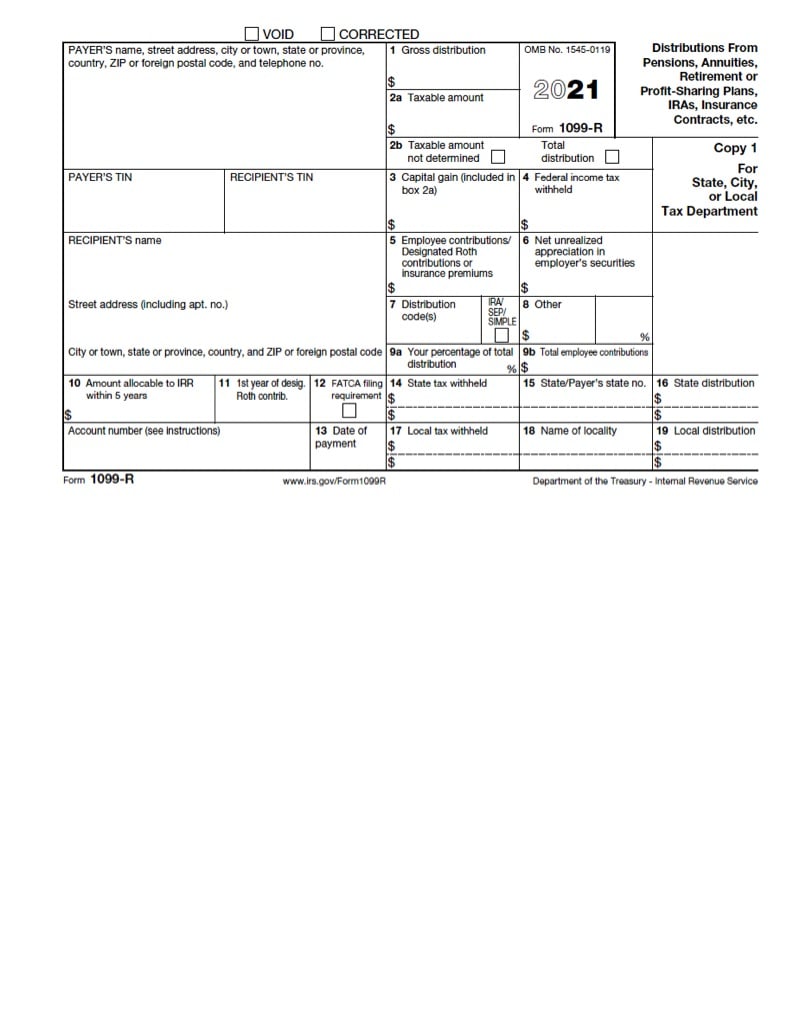

So consult your tax advisor. You should receive a Form 1099. If you inherit a non-qualified annuity the method by which you choose to withdraw the funds will determine how you are taxed.

Ad Americas 1 Independently Rated Source for Annuities. Variable annuities - make payments to an annuitant varying in amount. Because your wife chose to cash in the annuity a portion of what she received will be income from the invested funds.

The earnings are taxable over the life of the payments. Different tax consequences exist for spouse versus non-spouse beneficiaries. While having a guaranteed lifetime income sounds appealing it might be in your best interest to use this.

Annual payments of 4000 10 of your original investment is non-taxable. Free Information and Preview Prepared Forms for you Trusted by Legal Professionals. You live longer than 10 years.

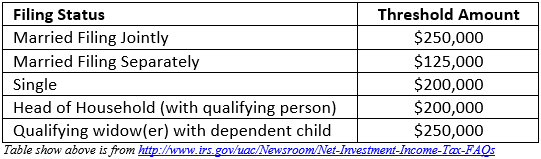

Ad Age-Based Funds that Make Selection Simple. To determine if the sale of inherited property is taxable you must first determine your basis in the property. The tax rate on an inherited annuity depends on the type of annuity and the beneficiarys relationship to the person who purchased the annuity.

You have an annuity purchased for 40000 with after-tax money. Ad Get this must-read guide if you are considering investing in annuities. If a trust charity or estate is the beneficiary of a.

Can I sell an inherited annuity.

Publication 590 B 2021 Distributions From Individual Retirement Arrangements Iras Internal Revenue Service

Annuity Beneficiaries Inheriting An Annuity After Death

How To Figure Tax On Inherited Annuity

Annuity Beneficiaries Inheriting An Annuity After Death

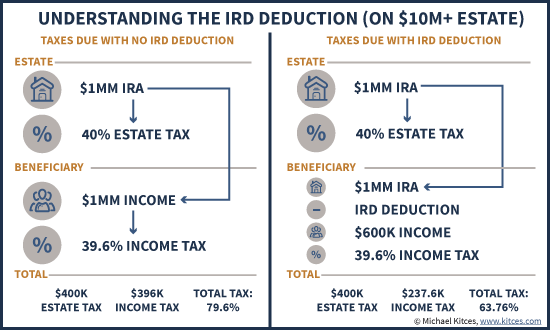

The Ird Deduction Inherited Ira Beneficiaries Often Miss

Tax Form 1099 R Jackson Hewitt

Taxation Of Annuities Explained Annuity 123

![]()

Inherited Annuity Tax Guide For Beneficiaries

Pass Money To Heirs Tax Free How To Avoid Taxes On Inheritance

/annuity-1a2c27eba1cb4ecf85aca9e888096cbd.jpg)

Are Variable Annuities Subject To Required Minimum Distributions

Inherited Annuity Tax Guide For Beneficiaries

How Are Annuities Given Favorable Tax Treatment Due

Annuity Tax Consequences Taxes And Selling Annuity Settlements

How Much Taxes Should I Plan On Paying For My Annuity By Due Com Due Com Medium

Annuity Taxation How Various Annuities Are Taxed

Inheritance Tax Here S Who Pays And In Which States Bankrate